Milelogs is a GPS powered mileage tracking app with automatic drive detection functionality making it easy to capture every single mile you drive in real time. It’s a great and powerful tool for automating the process of recording business mileage and removes the administrative burden of manually logging every trip optimising time and operational efficiency. Business mileage expenses are allowable as a deduction for tax purposes saving you £1,000’s in tax every year.

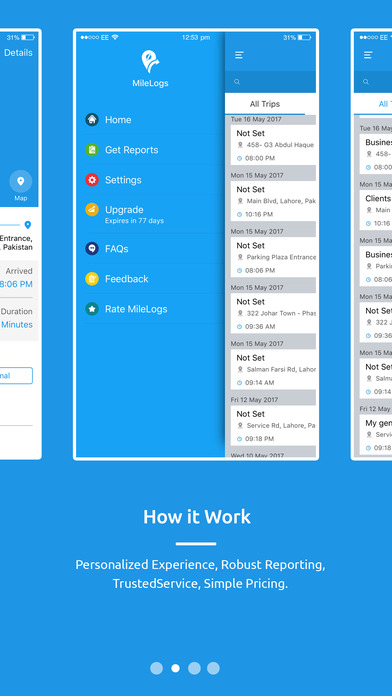

Functionality and Features:

- Automatic mileage record through drive detection functionality.

- Optimise time and operational efficiency by reducing administrative burden of manually logging every business trip.

- Easily classify your drives into business or personal mileage.

- HMRC compliance: Mileage allowance rates pursuant to HMRC guidelines.

- View mileage history.

- Analyse usage and generate reports.

Milelogs is an ideal tool for Company employees, sole traders and SMEs claiming mileage as a business expense.

1) The app has been designed to encompass following types of vehicles:

- Personal Cars & Vans for business purposes.

- Motorcycles for business purposes.

- Bikes for business purposes.

- Business Cars.

2) You can add a vehicle based on the aforementioned types under settings.

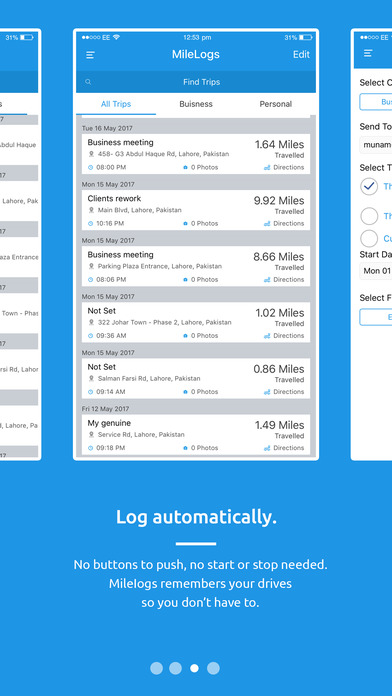

3) Every trip is automatically logged through the automatic mileage tracking and you can categorise it into business or personal journey at your own convenience. For each trip, the app captures the following data through smart drive detection technology:

- Start and End address

- Date & Time

- Total Miles

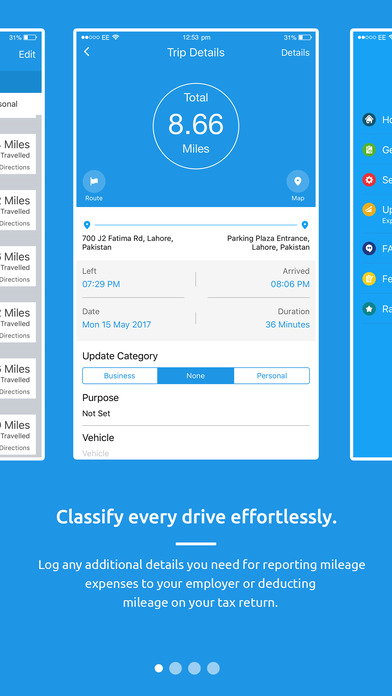

4) The categorisation process includes 3 simple steps:

- Categorise as business or personal journey.

- Description/purpose of journey, such as meeting Client X.

- Selection of vehicle from the list of vehicles added through the settings menu.

5) Once a trip has been categorised as a business journey and the aforementioned steps have been completed, it will automatically calculate the total amount you are entitled to claim by multiplying the total miles with mileage allowance rates specific to the vehicle type in line with HMRC rates.

e.g., if a personal car or van has been added and used for business purposes for a 200 mile journey, it will automatically calculate £90 as the amount you are entitled to claim (45p x 200 miles).

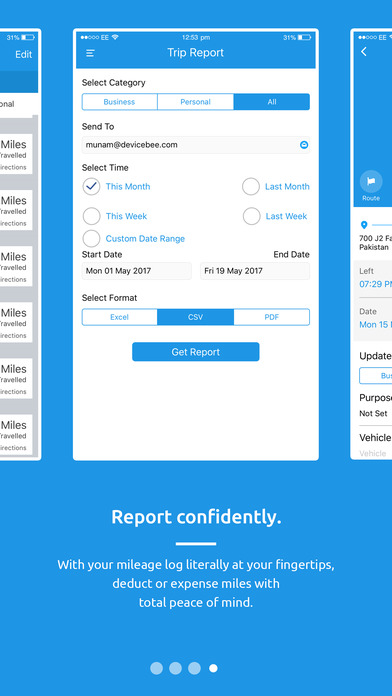

6) Export Reports for Record keeping & Compliance purposes :

This app provides you the platform for maintaining business mileage records in an efficient way and organised manner through its “export report” functionality. The app offers report extraction in 3 different formats, vis-à-vis, csv, pdf & excel. The app also offers date range facility and reports can be customised and extracted by date range.

7) Attach Fuel Receipts .

Users will be able to attach fuel receipts as evidence in support of business mileage expense claims. These receipts can be accessed for viewing and printing through our secure client login area on our website.